By: Karen Davila

By: Karen Davila

You do everything right. You’re careful to dot your i’s and cross your t’s. Compliance is hard-wired because you’re in an industry that’s highly regulated and you’ve built into your operations a series of compliance checks and balances. However, even with strong controls in place, compliance efforts sometimes fall short– and whether you’re a physician group, a pharmacy, a durable medical equipment company, a home health agency, or any other health care provider, someday you might find yourself face-to-face with law enforcement officials or regulatory enforcement authorities. What do you do? How do you assure the most successful outcome with minimal business disruption?

Compliance is the foundation to mitigating the risks inherent in any health care operation. Compliance can reduce the likelihood that regulators or law enforcement suddenly appear on your doorstep. But preparation for emergencies and uncertainties is the key to reducing the risk that non-compliance leads to lengthy business interruption. Although you may be saying “if”, you really should be thinking and acting more like “when”. It costs everything to be ill-prepared and it costs very little to be well-prepared. The following preparation can prevent much of the uncertainty that arises in these cases.

POLICIES AND PROCEDURES

First and foremost, make sure you have well-developed policies and procedures for what to do in such instances. You should review these policies and procedures with your employees regularly, focusing on the importance of compliance. Out of fear and uncertainty, employees can do things that create unnecessary challenges. Educating them as to what their rights and responsibilities are will mitigate those risks. Make sure your policies and procedures include the designation of who is in charge (“person in charge”) when the government does show up.Continue reading

By:

By:

By:

By:

Three family members involved in owning an addiction treatment center and/or a toxicology lab were charged in July with patient brokering and money laundering in an alleged scheme involving roughly $2 Million. The allegations arise out of a complex corporate enterprise involving at least four companies and some common ownership between the treatment center and lab. While it’s premature to assume that the defendants did anything illegal, there are some interesting things in this case:

Three family members involved in owning an addiction treatment center and/or a toxicology lab were charged in July with patient brokering and money laundering in an alleged scheme involving roughly $2 Million. The allegations arise out of a complex corporate enterprise involving at least four companies and some common ownership between the treatment center and lab. While it’s premature to assume that the defendants did anything illegal, there are some interesting things in this case:

By:

By:

By:

By:  June 1, 2020 – Florida Healthcare Law Firms adds experienced attorney

June 1, 2020 – Florida Healthcare Law Firms adds experienced attorney

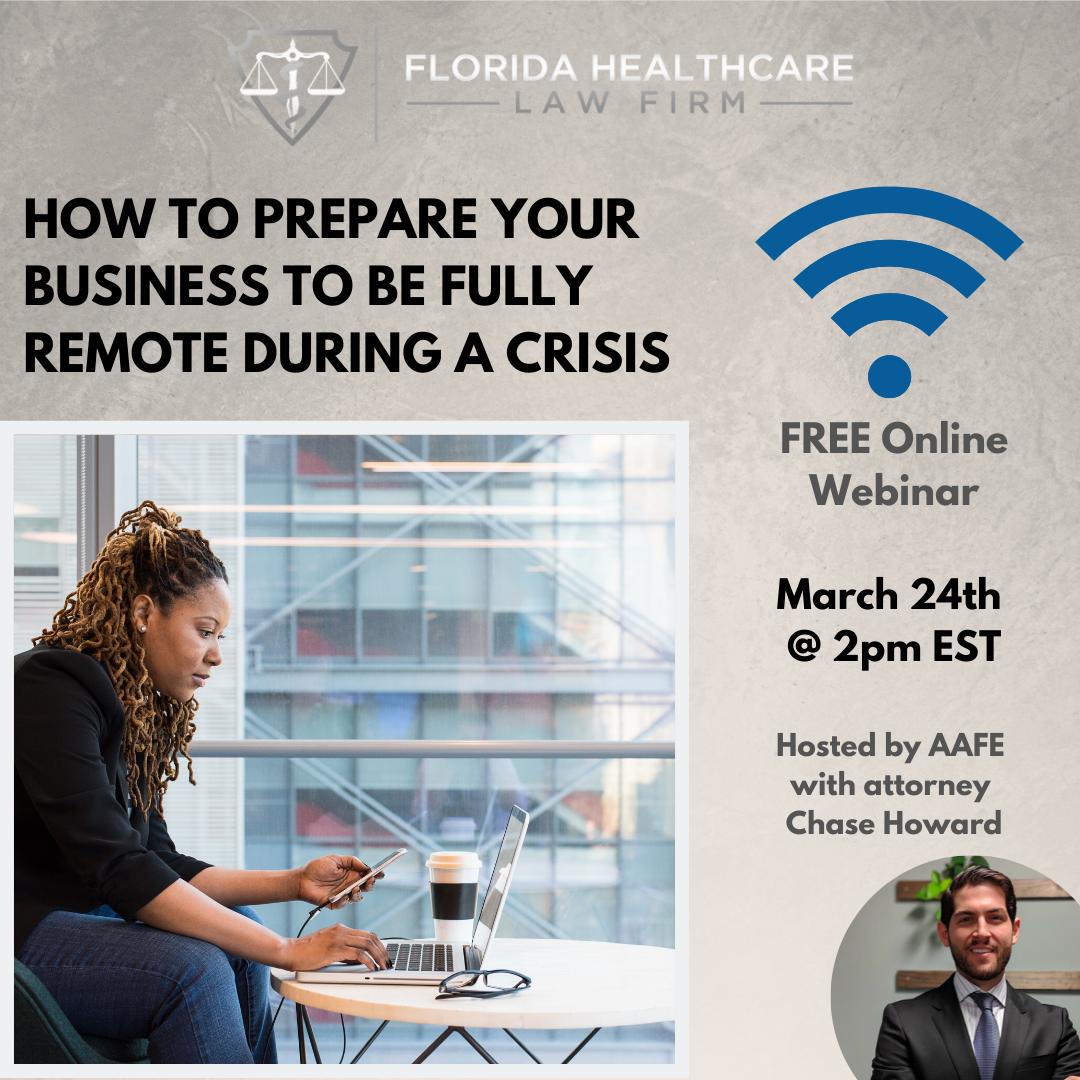

Join Florida Healthcare Law Firm Attorney Chase Howard on our

Join Florida Healthcare Law Firm Attorney Chase Howard on our

By:

By:

The Florida Healthcare Law Firm is hosting a free webinar for physicians on appropriate third party relationships. With shrinking

The Florida Healthcare Law Firm is hosting a free webinar for physicians on appropriate third party relationships. With shrinking