By: Jeff Cohen

By: Jeff Cohen

The Secretary of Health and Human Services issued blanket waiver of the Stark Law on March 30th in order to facilitate COVID related medical services. The waivers apply only to financial relationships and referrals related to COVID. The circumstances and conditions under which the waivers apply are strictly and narrowly described. Moreover, the waivers have no impact in the presence of fraud or abuse. With respect to physicians wanting to provide designated health services (e.g. clinical lab services) related to COVID detection and treatment, for instance–

- the federal requirement that the DHS be provided in the same building as the physician office is waived; and

- the financial relationship limitations between the physician (or family member) and the DHS provider is waived.

The waiver also contains specific examples of waived interactions between providers and hospitals, including—Continue reading

By:

By:

By:

By:

By:

By:

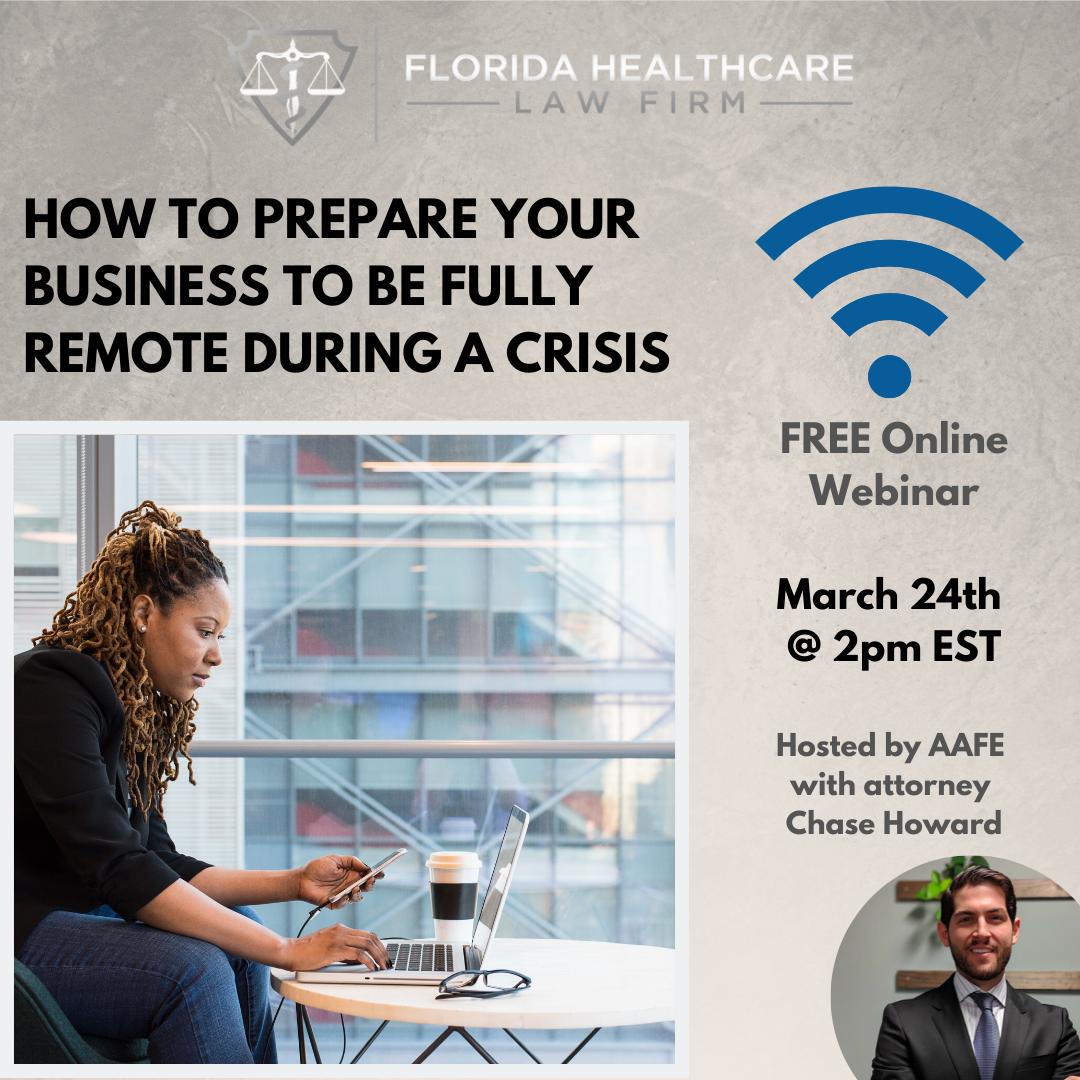

Join Florida Healthcare Law Firm Attorney Chase Howard on our

Join Florida Healthcare Law Firm Attorney Chase Howard on our

By

By

By:

By: