The U.S. Attorney arrested 13 people in a $100 Million healthcare fraud scheme in NY and NJ involving automobile insurance claims. Some of the facts alleged include—

- Bribed 911 operators and hospital employees for confidential information of insured drivers

- Unnecessary and painful medical procedures

- A non-physician owning medical clinics

- Paying hundreds of thousand of dollars to “runners” who used the money to bribe people

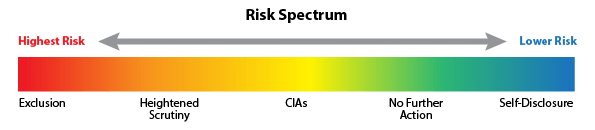

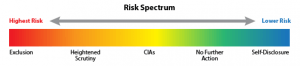

Healthcare businesses that largely serve people injured in motor vehicle accidents remain a top tier focus for law enforcement and special investigative units (SIUs) of insurers. But so do many other providers in the healthcare sector, such as pharmacies, durable medical equipment (DME) providers, addiction treatment providers and labs. Payer and governmental presumption is often that financial motives are driving clinical behavior, NOT documented medical necessity. Hence the need for active compliance plans and policies and procedures that don’t sit on a shelf, but rather are woven into daily business and clinical operations. Nothing less than the right contracts, the right compliance plan and the right business culture will establish and maintain a sustainable healthcare business!

By:

By:

By:

By:

By: Karina P. Gonzalez

By: Karina P. Gonzalez

By:

By:

By:

By:

By:

By: