By: Jeff Cohen

By: Jeff Cohen

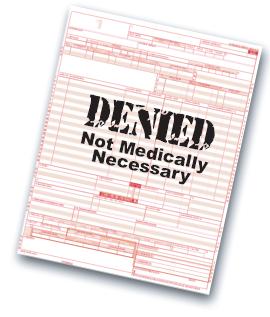

Addiction treatment providers continue to react to an assault by payers to run them “out of town.” The first round of attacks (in the Fall of 2014) focused on the practice of copay and deductible write offs. The phrase cooked up by lawyers for Cigna, “fee forgiveness,” wound its way into the courts system in Texas in a case (Cigna v. Humble Surgical Hospital, Civ. Action No. 4:13-CV-3291, U.S. Dist. Ct., S.D. Tex., Houston Division) against a surgery center, where Cigna argued that the practice of a physician owned hospital in waiving “patient responsibility” relieved the insurer from paying ANYTHING for services needed by patients and provided to them. Though the case did not involve addiction treatment providers, it gave addiction treatment lawyers a look into what was going to come. The same argument made in the Texas case was the initial attack by Cigna in a broad attack of the addiction treatment industry, especially in Florida.

As addiction treatment providers fielded Cigna’s “fee forgiveness” attack in the context of “audits,” providers held firm to the belief that justice would prevail and that they would soon restore a growing need for cash flow. “If we just show them that we’re doing the right thing,” providers thought, “surely they will loosen up the purse strings.” After all, this was a patient population in terrific need of help, with certain [untested] protection by federal law (the Mental Health Parity Act).Continue reading

By:

By: