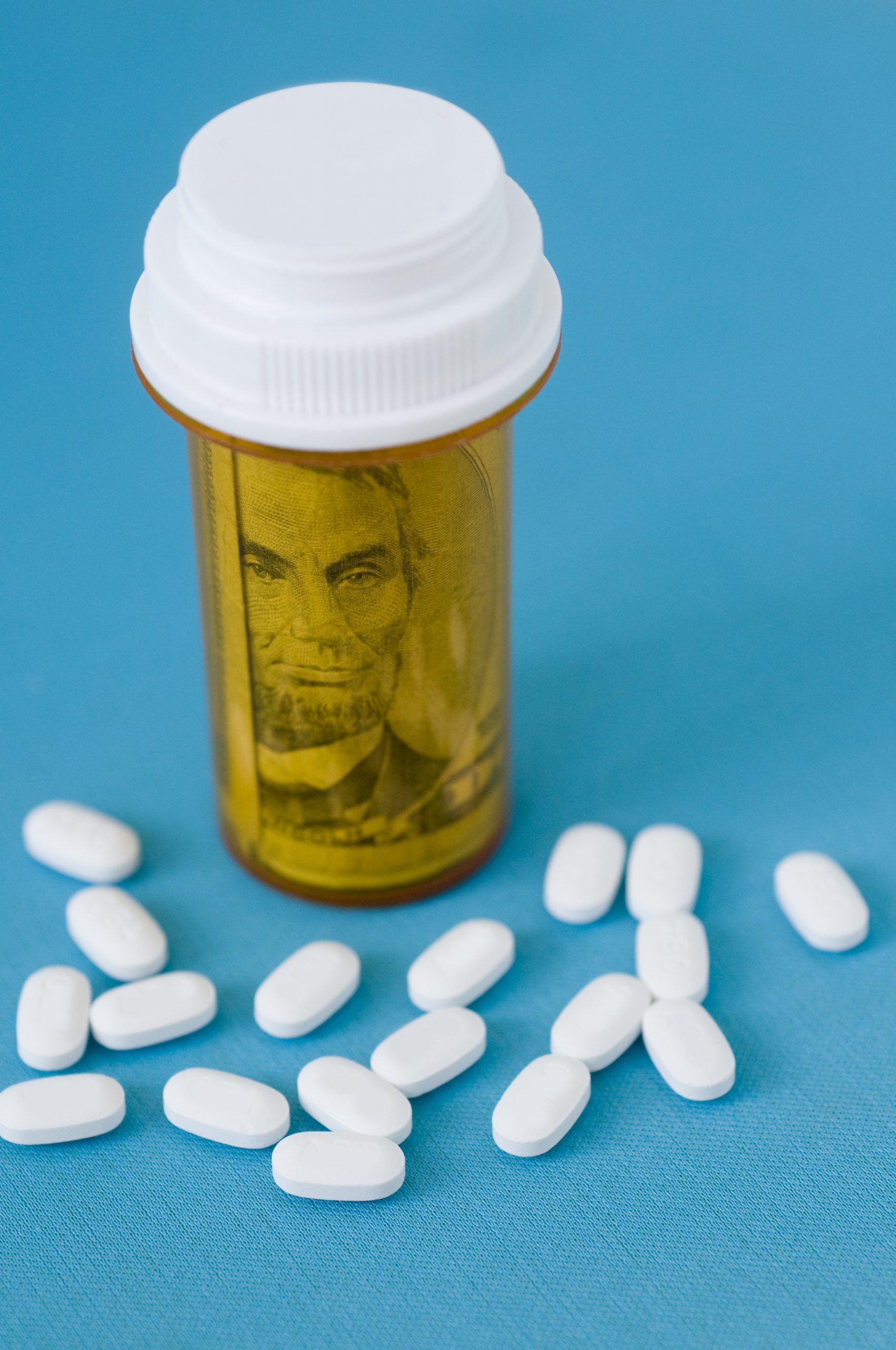

On January 1, 2022, a new federal law, “Requirements Related to Surprise Billing, Part I” (“The Rule”), goes into effect for health care providers and facilities and for providers of air ambulance services. The Rule will restrict excessive out-of-pocket costs to consumers which resulting from surprise billing and balance billing.

Group health plans and health insurers contract with a network of provider and health care facilities, these providers are considered as in-network providers. They agree to accept a specific payment for their services. Providers and facilities that are not contracted with a health plan or insurer are known as out-of-network providers (OON). They usually charge higher amounts than in-network providers. When OON providers do not receive full payment for their charge from the insurance payor, they charged the patient for the difference between the charge and the amount paid, a practice known as balance billing.Continue reading

By: Karina Gonzalez

By: Karina Gonzalez

By:

By:

By:

By:

By: Karina Gonzalez

By: Karina Gonzalez